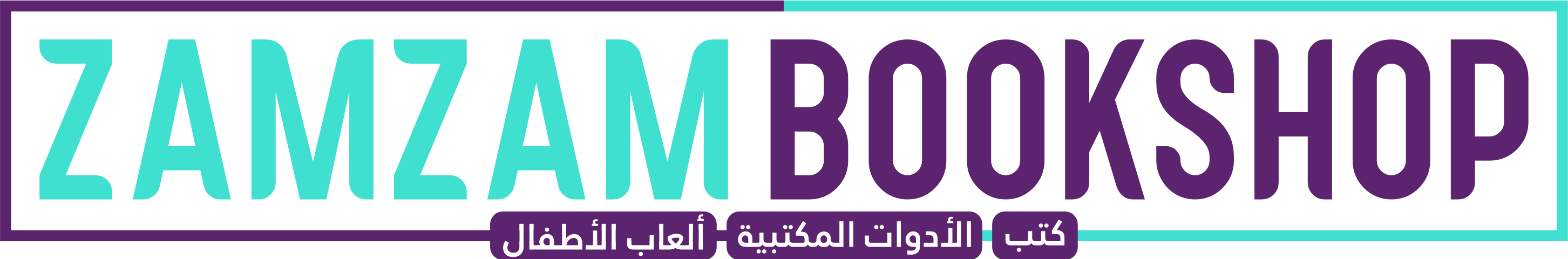

Money for Beginners by

Money is an essential part of our daily lives, and understanding how it works is crucial for making informed financial decisions. As a beginner, it can be overwhelming to navigate the world of money, but don’t worry, we’ve got you covered. Here’s a comprehensive guide to get you started:

Understanding the Basics

- Bank Accounts: A bank account is a place where you can store your money safely and securely. There are different types of bank accounts, such as checking and savings accounts, each with its own benefits and features.

- Earning and Borrowing: Earning money is a crucial part of life, and borrowing money can be a necessary evil. Understanding how to earn and borrow money responsibly is essential for building a strong financial foundation.

- Government Spending and Taxes: The government plays a significant role in our lives, and understanding how they spend and collect taxes is vital for making informed decisions.

Key Concepts

- Annual Percentage Rate (APR): APR is the interest rate charged on borrowed money, and it’s essential to understand how it works to avoid paying too much interest.

- Debt: Debt is a common phenomenon, and understanding how to manage it is crucial for avoiding financial trouble.

- Financial Literacy: Financial literacy is the ability to understand and manage personal finances effectively. It’s essential for making informed decisions and avoiding financial mistakes.

Resources

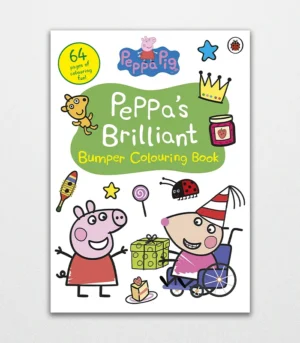

- Books: There are many excellent books available that can help you learn about money, such as “Money for Beginners” by Matthew Oldham, Eddie Reynolds, Marco Bonatti, and Lara Bryan.